Inflation in the Canadian economy has been on a steep increase since the start of 2021. Now as Canada begins to emerge from the COVID-19 pandemic, the hopes are for positive economic growth, however, it seems pandemic effects may stick around longer than most anticipated.

Pressure is now being put on the Bank of Canada to rein in rising inflation. The bank has held its position that high inflation is merely a “transitory” issue, though some are warning inflation may get worse before it gets much better.

What is the current inflation rate?

According to new figures from the CPI released this week, the current inflation rate in Canada reached a new high of 4.7% in October, in line with market expectations. While not the highest level in history, it’s the highest inflation rate Canada has seen since 2003 and is more than double the average pre-pandemic levels of about 2%.

This is up from about 1% at the start of the year and 4.1% in August. The U.S. has seen a similar spike in inflation, hitting above 6%. Central banks across the world are also reporting large growth in inflation.

What is the Consumer Price Index (CPI)?

The consumer price index is a means for measuring price increases in Canada and is the primary indicator used to determine inflation rates.

The CPI tracks the prices of eight major commodities in order to determine how the economy is inflating or deflating. Though various commodities may fluctuate in price, the broad selection of goods represents an average of Canadians’ household spending.

Eight commodity prices tracked by the CPI

- Food

- Shelter

- Household operations, furnishing, and equipment

- Clothing and footwear

- Transportation

- Health and personal care

- Recreation, education, and reading

- Alcoholic beverages, tobacco products and recreational cannabis

Each of these commodities is weighted in terms of relative importance. The CPI measures costs and applies an index value, the rate at which the index changes is expressed as the inflation rate. Monthly increases are projected out to find a hypothetical yearly rate, however, the rate rarely stays the same for a whole year.

Canadian inflation history

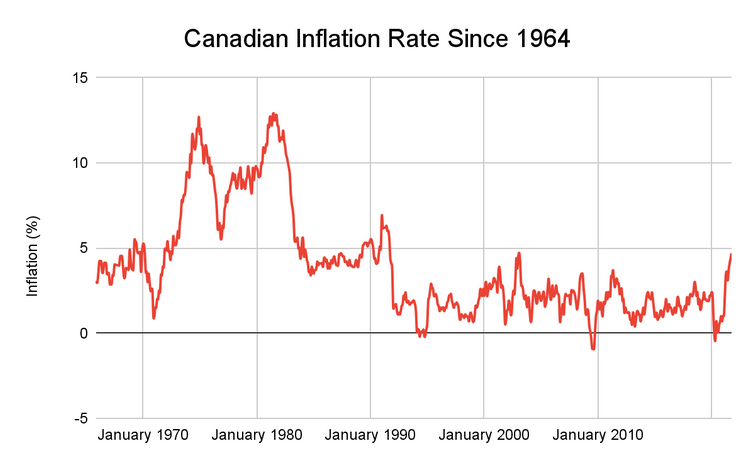

The last time Canadian inflation ran wild was in the 1970s and 80s when inflation rose as high as 14%. At that time, inflation was caused by a perfect storm of global economic conditions and failed governmental economic stimulation. This period of inflation during a recessionary period was known as Stagflation. Eventually, inflation was brought under control due in part to increased interest rates, and it gradually reduced until hovering around 2% for many years.

At the start of the COVID-19 pandemic, inflation actually dipped low for a brief period. From about March to May 2020, the CPI saw very low or no increases as markets faltered in response to new restrictions. The price of gas along with rent prices decreased, and travel expenses fell sharply.

However, as it became clear that difficult times were here to stay for the near future, prices in food, gasoline, housing and more began to rise as the difficulties in production and supply chains increased. Since then inflation has continued to tick up steeply.

What inflation means for Canadians

There is some contention in the understanding of inflation and how it . Some people actually see high inflation as possibly a good thing and a natural consequence of an unbalanced economy. They also point to positives such as the fact that inflated money makes paying off past debts even easier as the purchasing power of the dollar goes down.

On the other side of things are the arguments against inflation. These include the fact that as inflation goes up, uninvested savings actually decrease in value. This is of particular concern for the millions of Canadians approaching retirement age who are now seeing their funds dwindle.

There is also the fact that inflation is rising faster than wages. Prices are up all over and the labour force is starting to demand more compensation for their work, causing labour shortages in some areas. Overall, a less healthy and more unstable economy can lead to all sorts of turmoil both economically and socially.

What is the inflation forecast?

There is also much contention on how rising inflation will play out for Canada. Some forecast it as only a transitory adjustment that will subside, while others fear it’s a warning for things to come and a repeat of inflationary periods of the 1970s.

Recent inflation expectations predict that the CPI will rise above 5% by the end of the year, with multiple point increases still in the forecast in 2022. According to the Conference Board of Canada’s Index of Business Confidence, a majority of businesses polled feel inflation rates will rise 2% or more in the next six months. The central bank however hopes for average rates of 3.4 percent for 2022, up from a previous forecast of 2.4%. They aim to reach the target inflation rate of 2% by 2023.

What can the central bank of Canada do?

All eyes are now on the Bank of Canada as inflation rises. During the pandemic, the Bank of Canada cut their policy rate to record low levels in order to ensure the flow of money continued through the economy. They have committed to holding off until at least the second quarter of next year until they raise rates, and expect rising inflation to be a temporary issue.

Should they be wrong and inflation gets too out of control, they may be forced to announce an early interest rate hike, or a faster pace of increases, in order to combat inflation.

Bank ends Quantitative easing

Another means by which the bank has influenced the rate of inflation is through its quantitative easing program. Under this program, the bank bought up mass amounts of government bonds, causing their prices to surge and their yields to drop, thus lowering related rates such as fixed mortgage rates. Late last month, the bank opted to ease down this program, and many are saying this is a sign of increased interest rates to come.

Corben joined CREW as a relative newcomer to the field of real estate and has since immersed himself and learned from the experts about everything there is to know on the topic. As a writer with CREW, Corben produces informative guides that answer the questions you need to know and reports on real estate and investment news developments across Canada. Corben lives in Guelph, Ontario with his partner and their two cats. Outside of work, he loves to cook, play music, and work on all kinds of creative projects. You can contact Corben at corben@crewmedia.ca or find him on Linkedin at https://www.linkedin.com/in/corbengrant/.